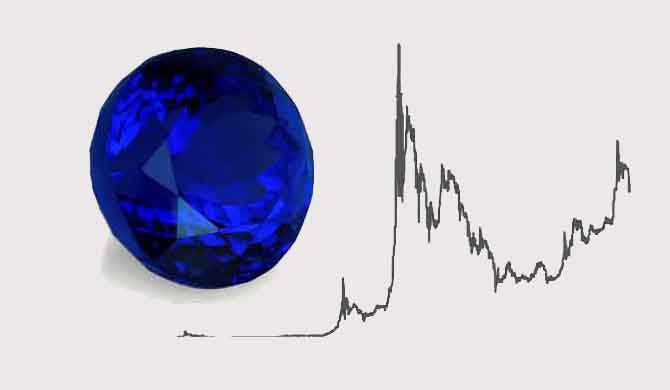

Looking to find out what the prices are in the market in 2025? Or perhaps you'd like to understand price trajectory since the 1990's? This article will bring you up to date.

A new discovery in the renowned Taita district of Kenya has taken the gem world by storm. We take a look at the new stone and the discovery.

Some of the world's finest and rarest Rubies are now mined in Africa. The traditional sources in Asia have been depleted and there's a new kid on the block. This article delves into the fascinating world of African Rubies, where and how they are mined.

There is a great deal of misinformation currently online regarding what "ethical" Tanzanite mining is. This article explores the different opinions.

Everything you need to know about Aquamarine Gemstones. Learn all about this beautiful, rare gemstone. Learn about its properties, how to judge quality, pricing, how it is mined, where it comes from and how to spot imitations.